A nonprofit can be exempt from paying federal taxes if the nonprofit is qualified as a 501(c)(3), 501(c)(4) or other eligible entity types. In Washington State nonprofits are subject to state and local taxes, but may be eligible for specific tax exemptions and deductions. The Tax Basics for Nonprofits Toolkit shares 5 things you should know about nonprofit taxes.

What We Cover in Tax Basics for Nonprofits

Registration with the Department of Revenue

Types of Taxes

Lowering Taxes

Audits

Consult with a CPA or Bookkeeper

Tax Basics for Nonprofits: 5 Things to Know

Download the Tax Basics for Nonprofits guide to learn 5 things that you should know about taxes for nonprofits.

View the Tax Basics GuideMore Resources

Employment Security Department

Washington State Department of Labor of Industries

Washington State Department of Revenue

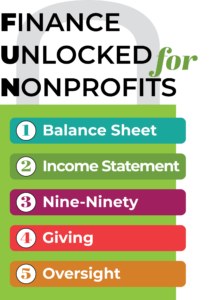

Continue Learning

Finance Unlocked for Nonprofits

Liquor, Cannabis, Gambling...and Your Fundraising Event

Important Note: This information is provided for educational purposes only and does not constitute legal or technical advice. If you are unsure about anything covered in Tax Basics for Nonprofits, we suggest that you contact the appropriate agency or seek professional advice. Also, laws impacting nonprofit organizations change over time. The information contained in this guide may become out of date.