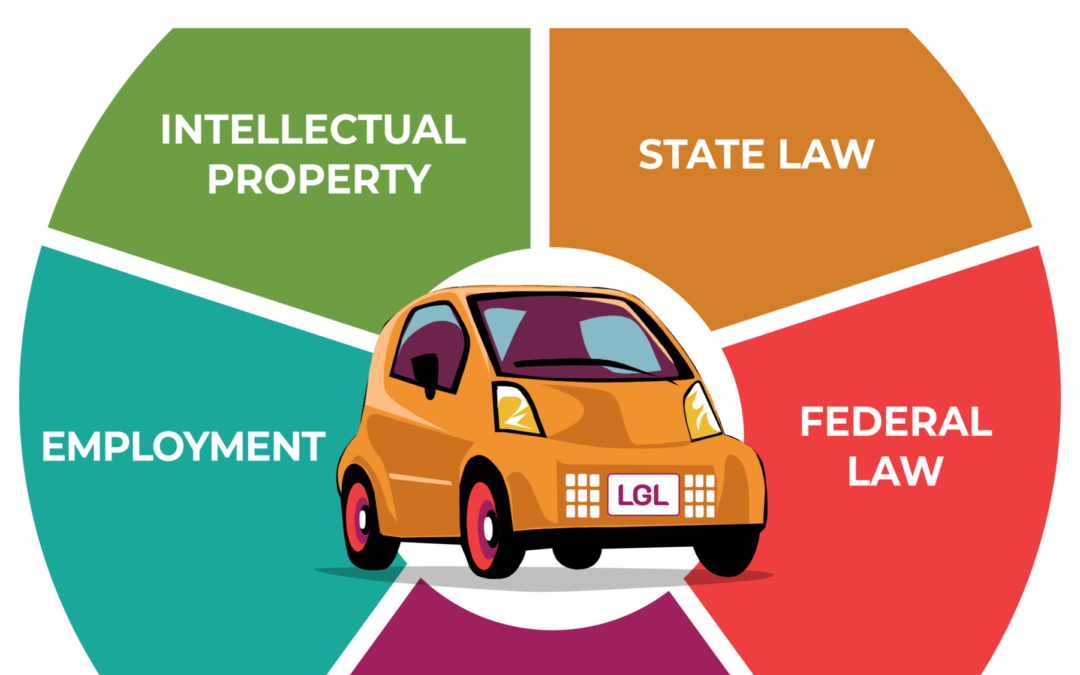

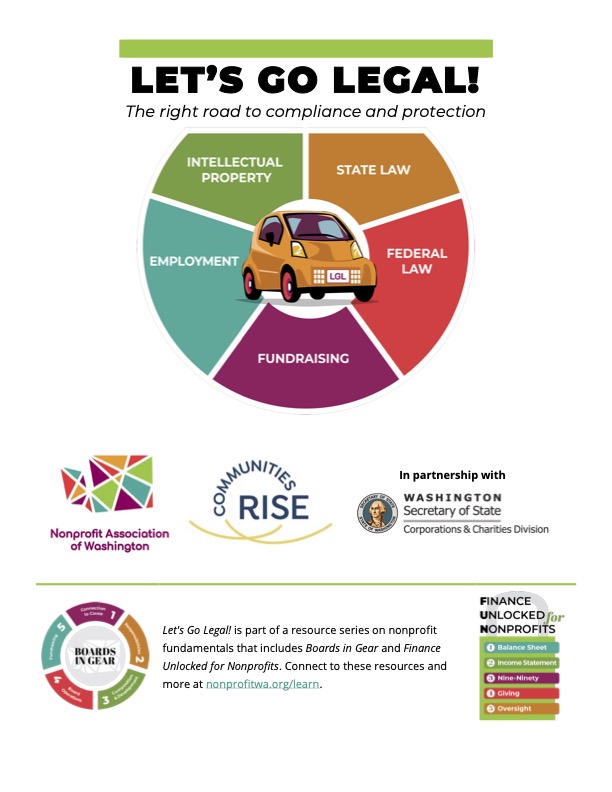

Your nonprofit’s mission is important. Let’s Go Legal is here to help you achieve it and stay compliant in the process. Get started on a road to compliance by thinking of your nonprofit like a car. Just like a car, you need to register your nonprofit and know how to operate the organization. There are state and federal rules of the road to follow. Your nonprofit needs money and resources (fuel) to power the organization. The people in the car matter too, these are your nonprofit’s valuable workers. Lastly, similar to cars, every organization has a unique look and feel as well as special materials that you may want to protect.

Upcoming Let's Go Legal Events

Let's Go Legal Guide

Start by downloading the Let's Go Legal guide that includes checklists, activities, and reflection questions. As you work through the guide, watch the video for each chapter. Find templates and other documents to help put what you learned into practice in the document vault, and check out the interactive LGL graphic. Keep on learning with other resources and upcoming workshops on nonprofit legal topics.

Download the GuideWhat We Cover in Let’s Go Legal

Introduction

Start by outlining important legal considerations for nonprofits. You will get an overview of the content covered in the following five chapters.

State Law

To become official, a nonprofit must first register with the state. The organization needs to stay compliant with state corporation law and other state law requirements, including filing corporation and charity reports every year.

Federal Law

Nonprofit organizations who want their revenue to be exempt from federal income tax and want to be eligible to receive tax-deductible contributions must follow additional federal rules.

Fundraising

When a nonprofit accepts other people’s money for a charitable purpose, the organization agrees to abide by laws that require such money be spent on the purposes for which it was intended. There are state and federal rules that tell a nonprofit how to communicate about money received, how to account for the money, and what kinds of fundraising an organization can conduct.

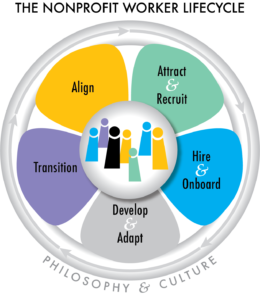

Employment Law

People engaged in the work of an organization help move the mission forward. An organization’s valuable workers may include paid employees, volunteers, interns, and independent contractors, and each type of worker has a role and legal compliance considerations.

Intellectual Property

Nonprofits use a name, logo, website, and special materials that communicate who the organization is and share ideas that are intangible. Whether shared on websites, used in print materials, or captured through unique research on the issues the organization addresses, protecting the ideas and products of a nonprofit is vital. Likewise, it is important that nonprofits are careful about how the ideas of others are used in their activities.

Document Vault

We’ve collected valuable resources, tools, and links for you and your organization in our Let’s Go Legal document vault.

2022 Washington Nonprofit Handbook

Articles of Incorporation Template – Members

Articles of Incorporation Template – Without Members

Bylaws Template – With Members

Bylaws Template – Without Members

Chapter: Employment Law – Guide

More Resources

Bolder Advocacy

National Council of Nonprofits

Washington State Office of the Secretary of State Corporations and Charities Division

Communities Rise

Stanford Law School Nonprofit Corporation Forms and Documents

Washington State Department of Labor & Industries

Continue Learning

Starting a Nonprofit

Workers in Nonprofits

Tax Basics for Nonprofits

Liquor, Cannabis, Gambling…and Your Fundraising Event